- The Pulse by 42neurons

- Posts

- OpenAI & Anthropic’s projected annual recurring revenue

OpenAI & Anthropic’s projected annual recurring revenue

Hey there!

Welcome back to The Pulse, where we dive into interesting AI stories and trends backed by data, all presented through simple visuals.

> Altman said OpenAI revenue “well above $13B,” targeting $10B → $100B by 2027 - a 3 yr 10× leap never achieved; target pulled forward a year as growth runs ~3× YoY

> but Microsoft’s recent filing showed $4.1B OpenAI charge, implying ~$12B loss last quarter

> internal plans forecast ~$115B burn through 2029, keeping FCF negative until ~2030 (when profitability begins)

> OpenAI current revenue vs 2028 projected: ~75% vs 50%; rest from ads, shopping, search from Google, Amazon and Meta - leveraging ~800M weekly users

> Anthropic API revenue ~$3.8B vs OpenAI’s $1.8B; growth driven by B2B expansions with Salesforce, Deloitte & Cognizant

> Claude Code nears $1B ARR (up from $400M Jul); Anthropic raised $13B @ $170B valuation, eyes $300 - $400B next (vs OpenAI ~$500B)

> margins improving from – 94% (2024) → 50% (2025) → 77 % (2028), driving + $17B FCF vs OpenAI – $45B

> 79 new unicorns in 2025; 22 (≈28%) are AI

> 53 (≈67%) of 79 total HQ’d in the U.S., rest split China, India, Germany & UK; Lovable & Modular from Stockholm

> top private: OpenAI ~$500B (overtook SpaceX, ByteDance)

> AI took 51% of 2025 VC, with U.S. taking 85% of AI funding & 53% of AI deals

> ~498 AI unicorns globally, ~$2.7T aggregate valuation

> most are early revenue (with some no-revenue); valuations based on growth potential rather than profit

> Thinking Machines Lab raised ~$2B seed at ~$10–12B val within months of founding

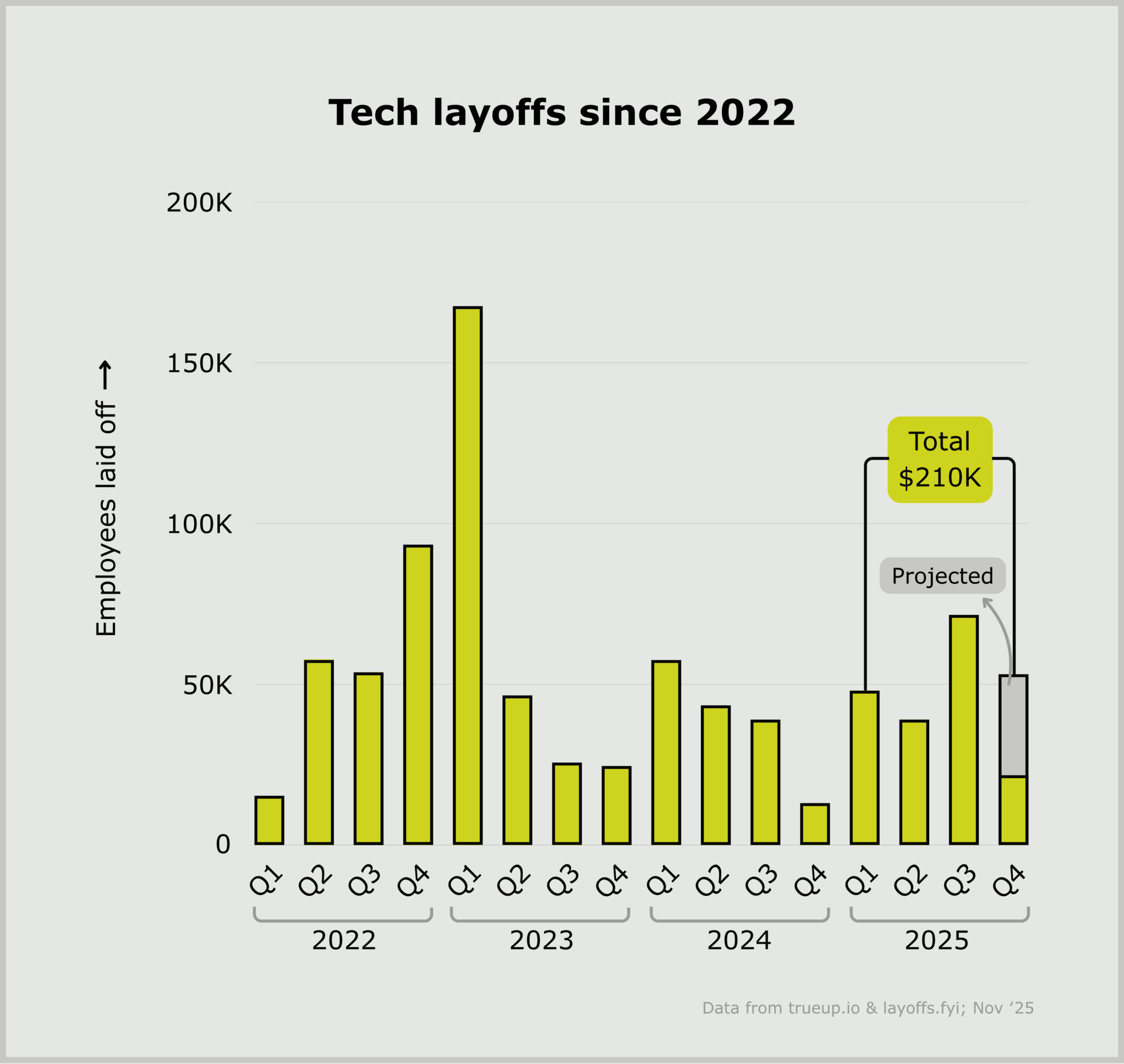

> tech layoffs peaked in 2023 Q1, with 585+ (½ 2024 total) companies announcing cuts

> total layoffs since 2022 ≈819K; 2025 YTD ≈178.6K (100K US alone)

> Intel (27.1K), Microsoft (15K) & Amazon (14.6K) top 2025 offenders

> ~50K roles in 2025 alone reshaped or replaced by AI-automation

> layoffs tied to shifting spend from headcount → AI infra & compute build-outs

> despite record cuts, net AI hiring (MLOps, data infra, model evaluation) remains positive, signaling workforce transition