- The Pulse by 42neurons

- Posts

- NVIDIA's quarterly revenue since 2022

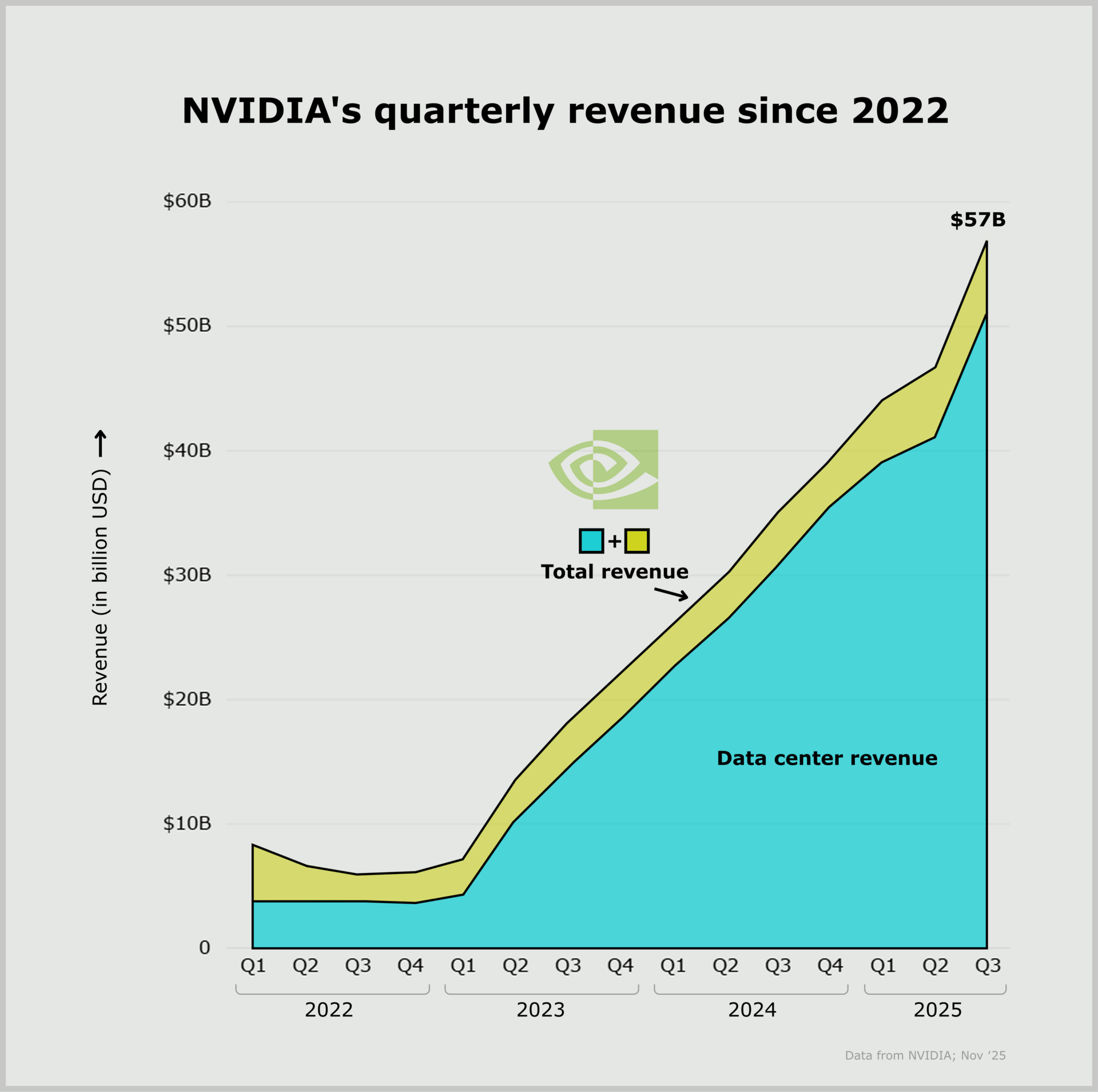

NVIDIA's quarterly revenue since 2022

Hey there!

Welcome back to The Pulse, where we dive into interesting AI stories and trends backed by data, all presented through simple visuals.

> highest-ever Q3 revenue: +22% QoQ (quarter on quarter), +62% YoY (year on year)

> data center's share = $51.2B ($43B GPUs + rest networking) + grew ~13.5× faster than rest of their business as Jensen claims cloud GPUs sold out

> but 4 customers = 61% of sales; has $26B worth of rent-back chip contracts

> Q4 revenue guide raised to $65B vs earlier $61.6B

> earlier warned $8B China revenue loss (total addressable market = $50B) but Trump now allows H200 (18 months old) sales to approved China buyers with 25% govt cut

> speculation: reversal aimed at avoiding NVIDIA demand collapse/irrelevance + preventing an AI bubble burst while China builds its own chips, weakening the US via financial shock

> FT says China will still limit access despite new export allowance

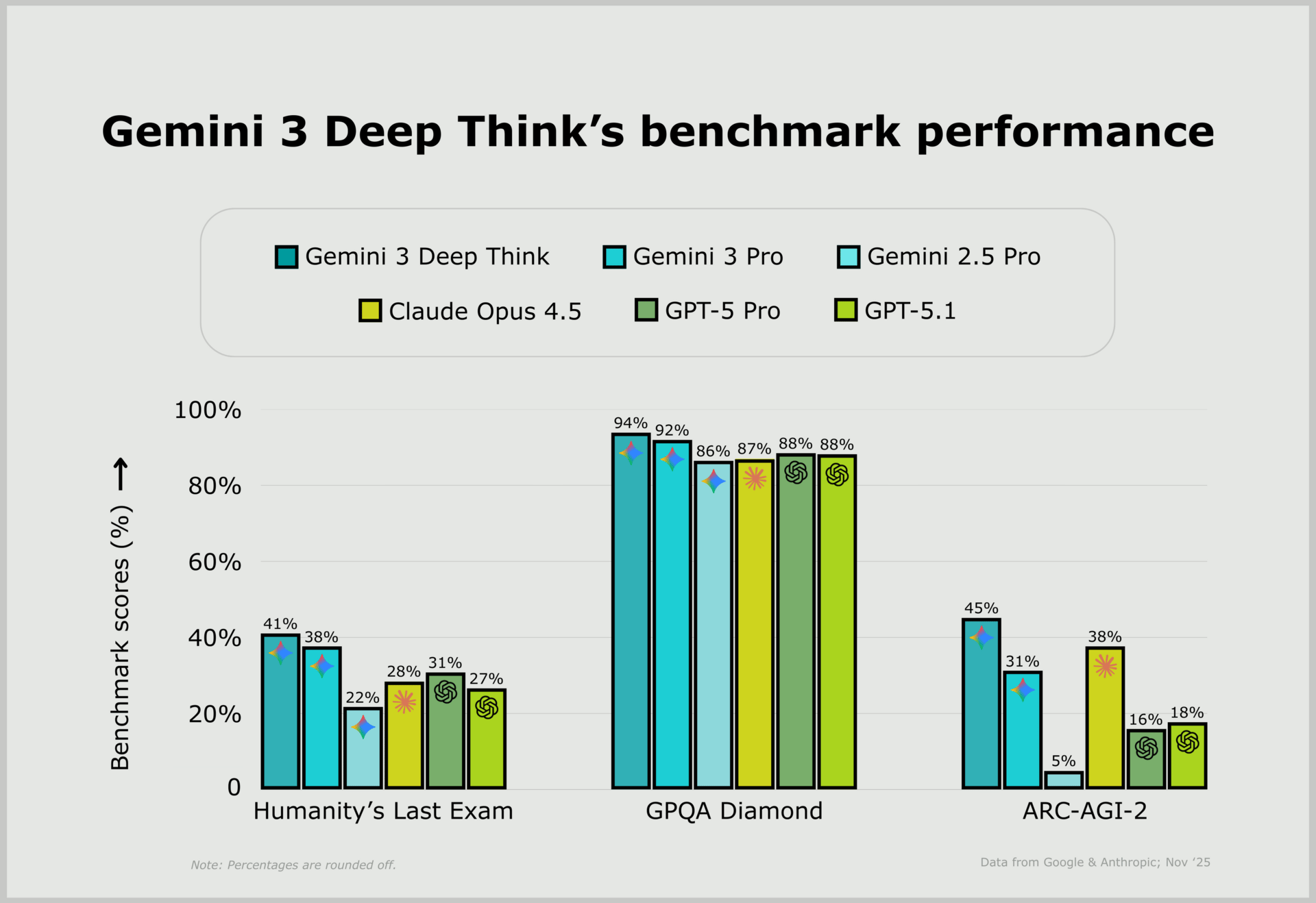

> Gemini 3 Deep Think mode now available to Google AI Ultra subscribers on the $250/m plan

> first model to cross 40% on both HLE (without tools) & ARC-AGI 2

> uses advanced parallel reasoning to explore multiple hypotheses simultaneously

> OpenAI reportedly rushing GPT 5.2 “Garlic” release as a “Code Red” response to Gemini 3’s overall lead

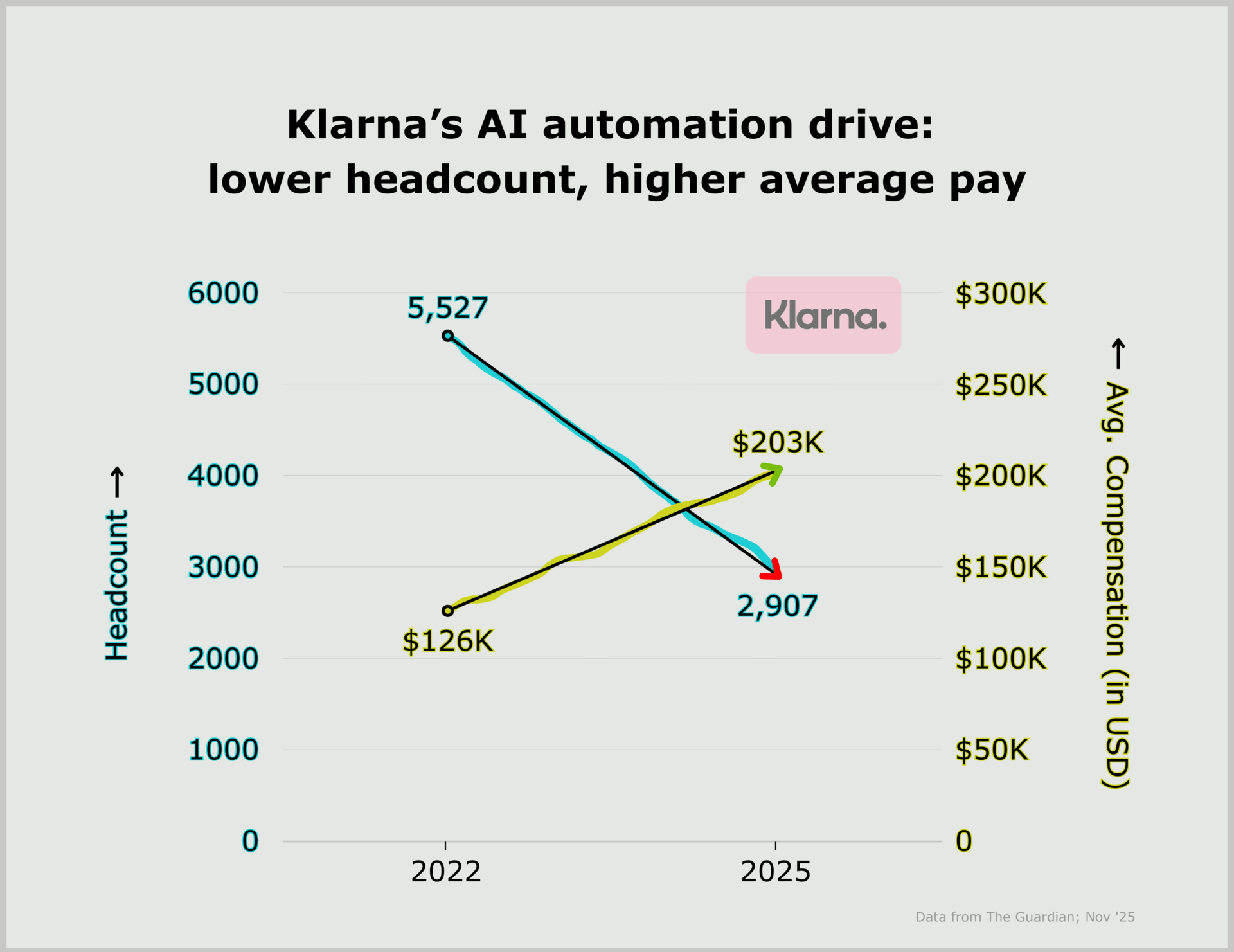

> ~48% cut in headcount + ~60% rise in pay driven by AI automation

> automation now covers work of 853 employees, up from 700

> revenue up 108% with operating costs flat; revenue per employee hits $1.1M

> latest quarter: revenue +26% to $903M but recorded a $95M loss

> however reports note Klarna hired humans again for the first time since 2023 after over-relying on automation & over-indexing

> overall internal workforce transitions this year still unclear