- The Pulse by 42neurons

- Posts

- SpaceX & xAI converge to form a $1.25T private entity

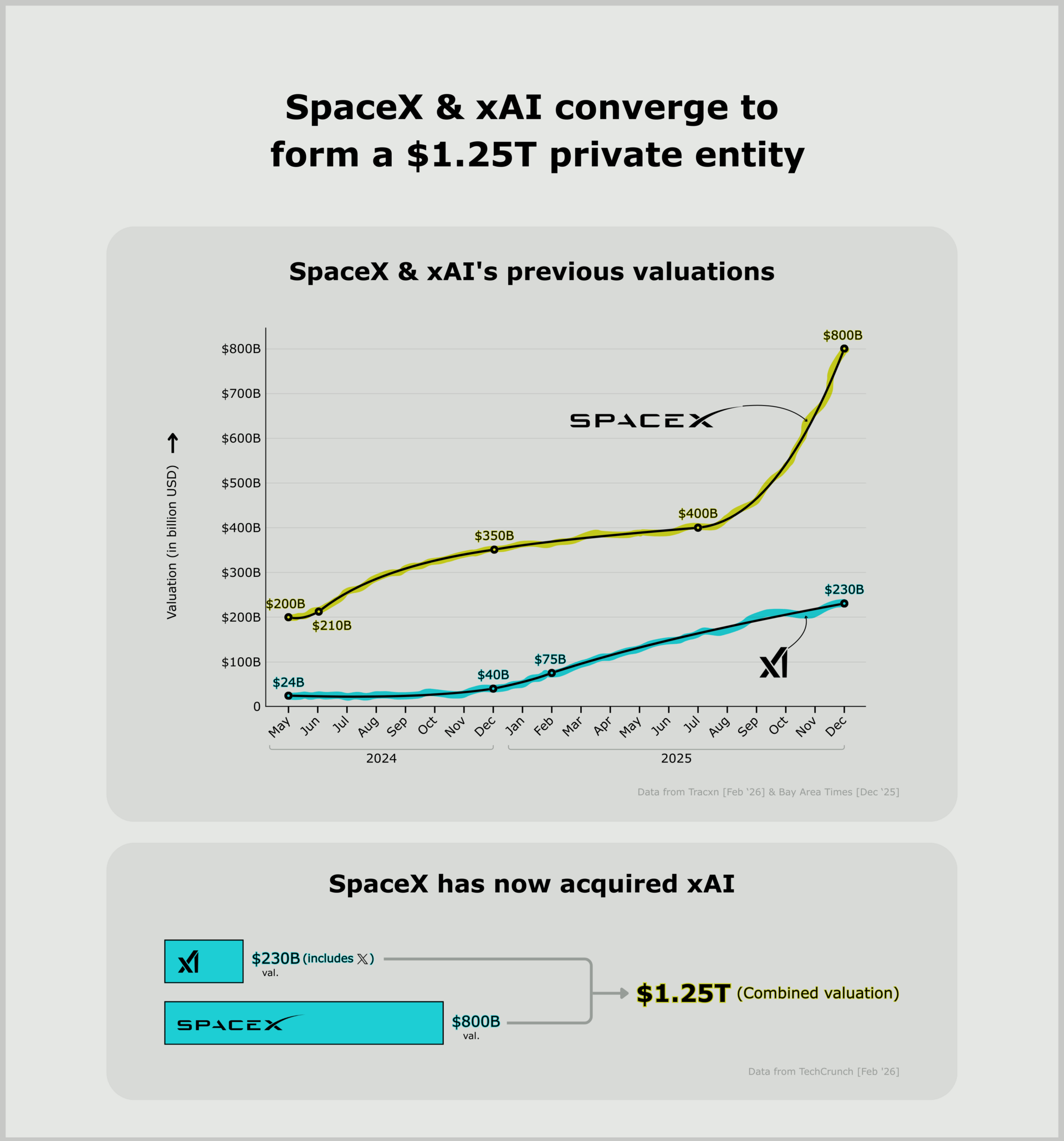

SpaceX & xAI converge to form a $1.25T private entity

Hey there!

Welcome back to The Pulse, where we dive into interesting AI stories and trends backed by data, all presented through simple visuals.

> X + xAI merged last year, both + SpaceX now → most valuable private entity, beating OpenAI before IPO later this year

> one entity to be “innovation engine” of AI, rockets, space-based internet & media

> motive for the merger: space datacenters running on solar energy (cheapest option soon)

> BigTech capex rising, Huang claims 100x energy needed, datacenter demand skyrocketing → all indicating cheaper energy needed, inspiring Musk’s move

> Musk increasingly intertwining businesses: Tesla announced $2B into xAI, X data fed into Grok, SpaceX + xAI merge for space datacenters & solar

> now Tesla also drops car models in a major pivot to humanoid robots instead

> all entities moving to one direction, though Musk claimed July 2025: no support for Tesla-xAI merger

> xAI previously third in private valuation behind OpenAI & Anthropic; Grok under major fire for nonconsensual porn images, but investors undeterred

> Tesla stock also up + Musk stands to gain beyond current ~$700B net worth from deal

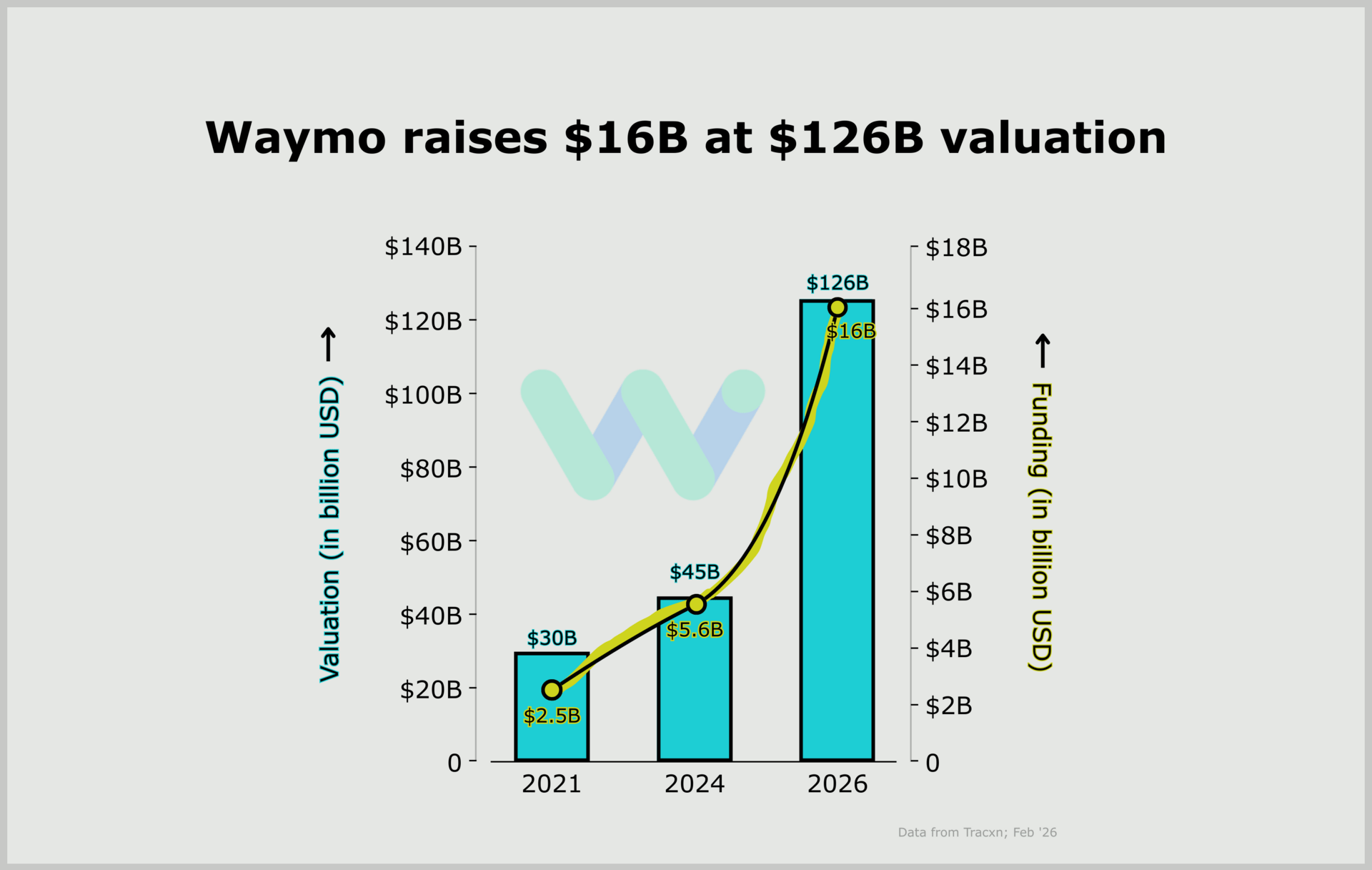

> beat previous expectation of $15B raise at $110B valuation

> 15M autonomous vehicle (AV) rides in 2025, 20M total till date; targeting 1M/week in 2026

> ARR $350M+ at 400K rides/week across 6 US cities despite generally higher prices; 20 city expansion this year, including Tokyo & London

> London & Middle East heavy target for both China & US AV operations, Baidu also launching this year (Apollo Go at 17M total rides as of Nov 2025)

> Dubai & Abu Dhabi target 25% autonomous trips by 2030 & 2040 respectively, led by China

> Chinese Baidu, Pony.ai & WeRide also partnering with Uber & Lyft, catching up with American counterparts

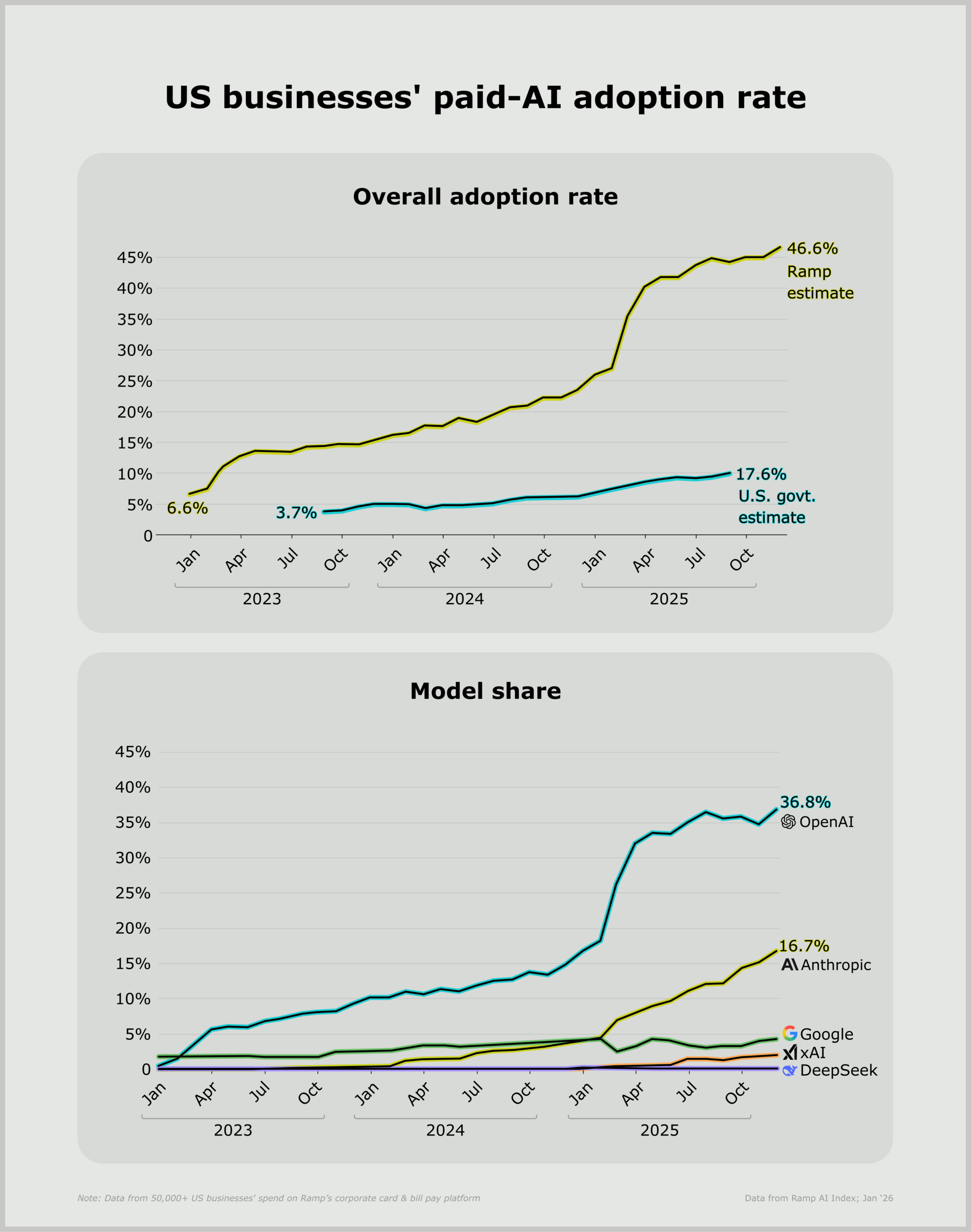

> Ramp: AI adoption sees biggest jump since July, led by enterprise chat + OpenAI API spend

> OpenAI reversed temp decline to add 2% since Nov; Anthropic also up 1.6% as tech sector heavy on API spend

> Google possibly undercounted due to free Workspace users

> financial services led growth at 3% as tech tops overall adoption at 75%

> not much divergence in adoption among different company sizes

> Gallup survey confirms trends: among US workers, 12% use AI daily at work & 25% use weekly vs 21% using only occasionally in 2023, with tech leading & finance following