- The Pulse by 42neurons

- Posts

- Cerebras raises $1B at $23.1B valuation

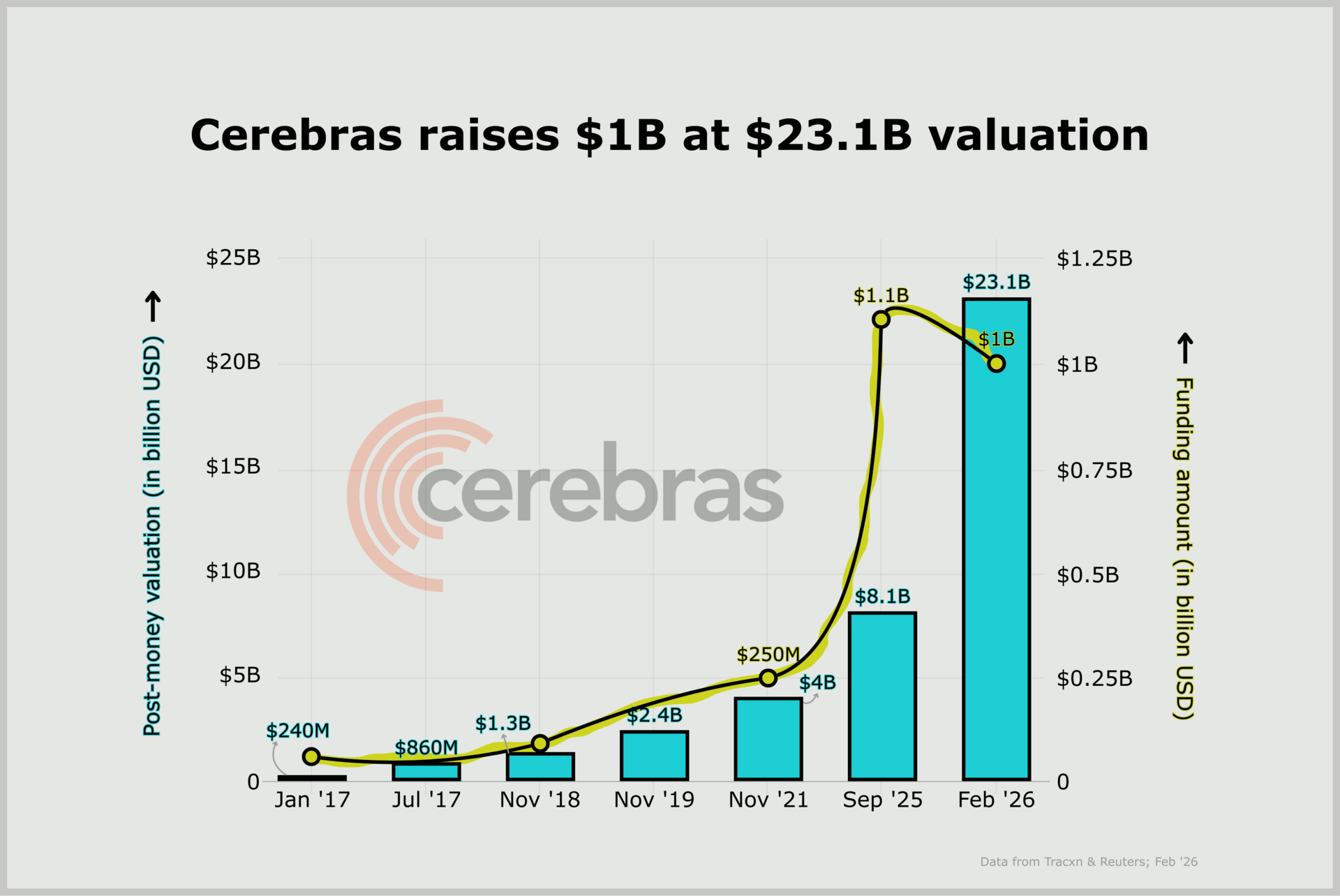

Cerebras raises $1B at $23.1B valuation

Hey there!

Welcome back to The Pulse, where we dive into interesting AI stories and trends backed by data, all presented through simple visuals.

> $23.1B val vs expected $22B, 3x in 4 months

> part of OpenAI’s NVIDIA alternatives as OpenAI reportedly unhappy with latter’s inference chip speed

> now seeking alternative hardware for 10% of inference computing needs

> Cerebras also rejected NVIDIA acquisition, which affected competitor Groq (acqui-hired by NVIDIA in $20B licensing deal)

> instead signed multi-year $10B+ compute deal directly with OpenAI, for 750MW capacity through 2028

> first funding round since IPO withdrawn to rack up private capital, but proceeding with IPO this year as deals expand with IBM, Meta, others

> backers: Tiger Global, Benchmark, Fidelity, AMD (another OpenAI partner), etc.

> valuation 3x YoY after recent round; first raise in a year (previous Sept valuation from secondary tender sale)

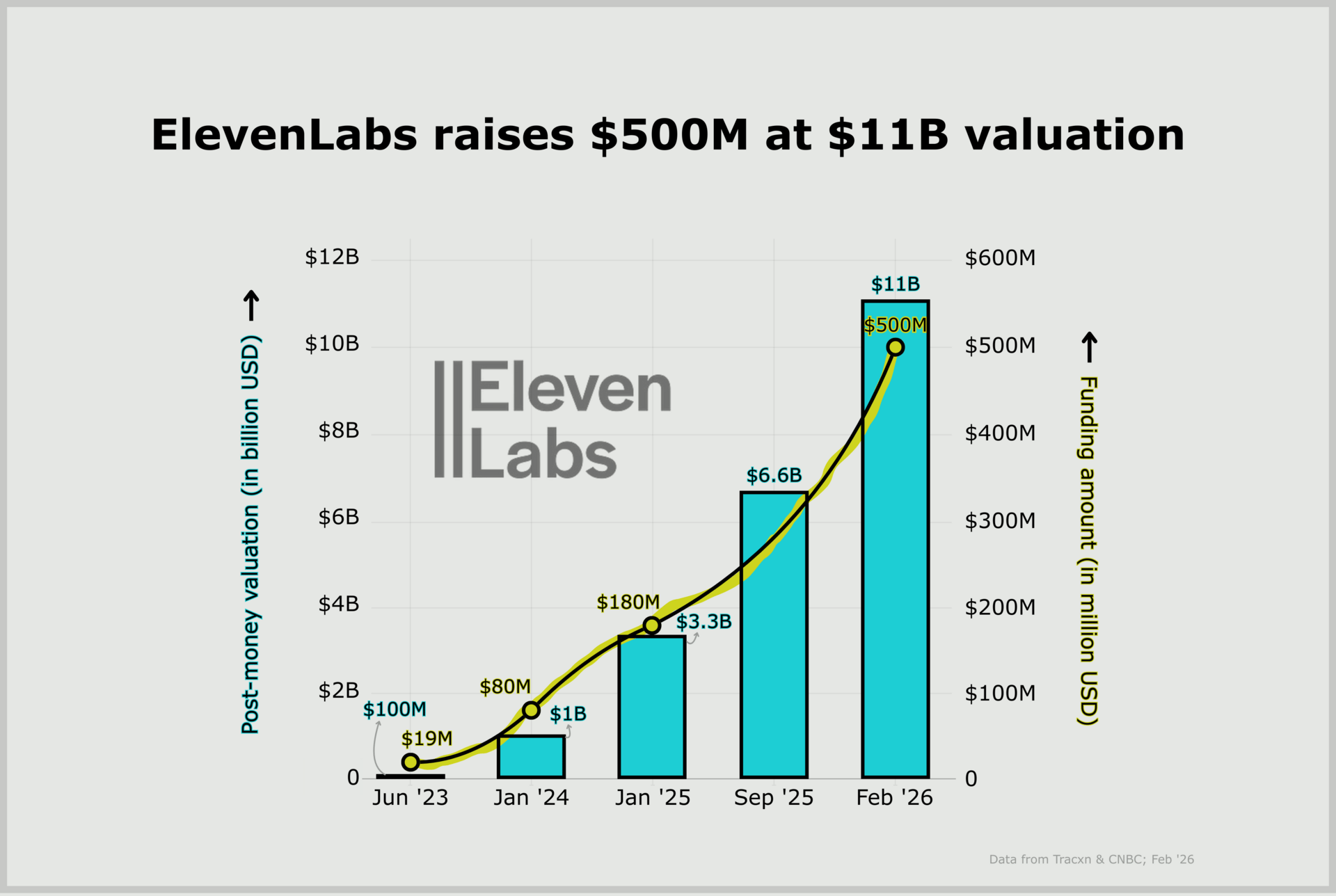

> now 3rd largest AI unicorn in Europe after Mistral & Helsing

> total funding ~$800M now, with ARR reaching $330M in 2025 (added $100M in 5 months from $200M); targeting 2x growth in 2026

> planning eventual IPO while expanding from voice AI to video + agents too

> recently released marketplace licensing famous artists' voices after settling multiple lawsuits since inception

> current customers: Revolut, Meta, Deliveroo etc.

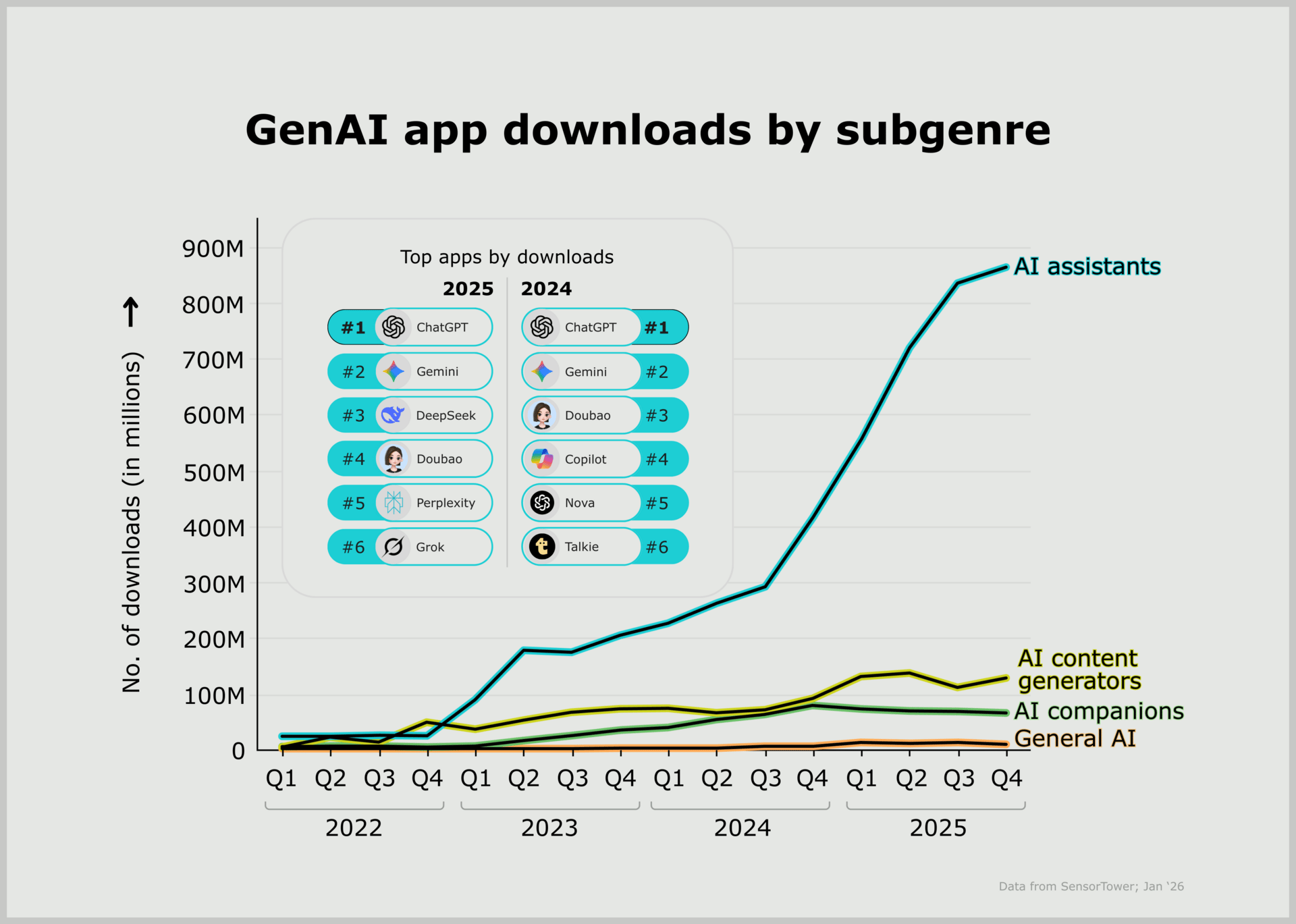

> 2022-2024: AI chatbots led, followed by AI art generators as distinct subgenre

> AI art generators absorbed into broader "content generation" category including music (Suno), video (Sora), etc. due to widespread AI adoption across formats

> 2025: all top 10 apps by global downloads were AI Assistants

> AI Companion apps (Character AI, PolyBuzz) still downloading well but growth slowing - Character AI dropped out of top 10 in 2025

> Market consolidating: ChatGPT, DeepSeek + Big Tech now dominate 80% of downloads vs 35% in 2023, early players squeezed to 25%